ASC 842 Compliance: Avoid Fines & Save Time with Asset Panda

White Paper

Get The White Paper

No matter the size of your organization, it’s essential to track and manage the assets your business relies on. For any assets that your organization leases, it’s not only important to keep up with key contract terms and dates but also comply with lease accounting standard ASC 842.

What is ASC 842?

The ASC 842 standard was introduced to increase transparency into lease liabilities and more accurately measure the financial health of an organization. With the ASC 842 standard, organizations are required to classify their leases as either finance leases (leased assets that they’ll have the option to purchase outright) or operating leases (assets that will not have a transfer of ownership at the end of the lease term).

As of 2018, publicly traded companies with leases for greater than 12 months must include them on the company’s balance sheet. Due to the COVID pandemic, the ASC 842 effective date for private and non-profit companies with sizeable lease obligations was pushed from 2019 to late 2021.

ASC 842 Requirements

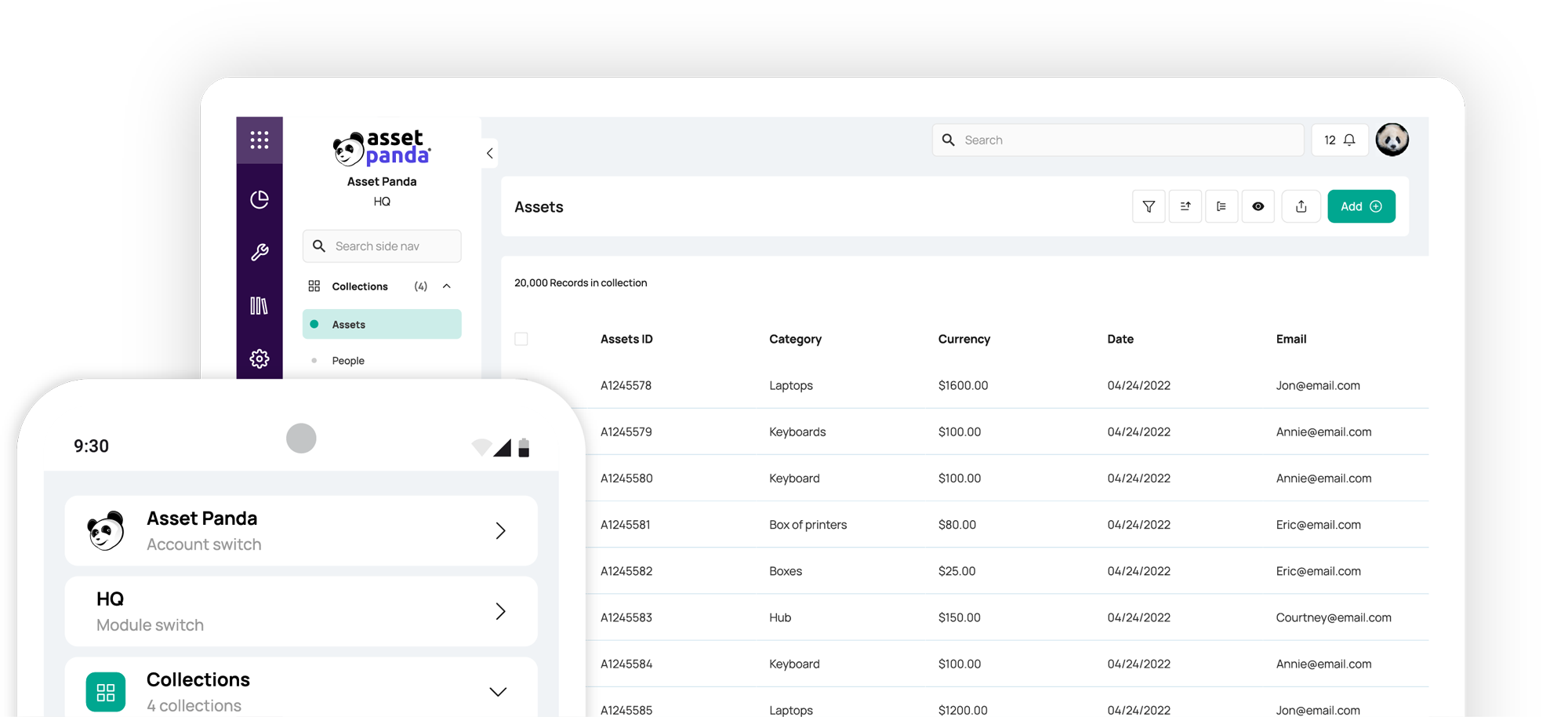

To achieve compliance with the lease accounting standard, organizations need robust ASC 842 software to accurately report on the costs associated with their finance and operating leases. A flexible asset management platform is one option to help companies effectively track their lease liabilities and manage their leased assets in one cohesive system.

In this whitepaper, we’ll discuss:

- What the ASC 842 lease accounting standard entails

- The requirements for achieving ASC 842 compliance

- Tips for selecting the right ASC 842 software

Ready to learn more about ASC 842 requirements and choosing the right software to attain compliance? Get your copy of the whitepaper today.

Related Resources

Learn more from a solution specialist

Schedule a demo to find out how you can transform your workflows with Asset Panda Pro

Contact our team at (888) 928-6112