Is Computer Software a Fixed Asset or Intangible Asset?

Blog

Table of Contents

Take Control of Your Assets

A personalized demo is just one click away.

Assets can be categorized as fixed or current, tangible or intangible, but is software a fixed asset or intangible asset? For accounting purposes, it’s important to distinguish if computer software is a fixed asset for effective tracking and reporting.

Fixed assets can be defined as assets purchased for long-term use. A company is unlikely to buy fixed assets just to turn around and sell them for a profit. Instead, fixed assets are resources that can be used to help the company earn revenue over time. In that way, they differ from current assets, like investments or inventory, which companies maintain for the express purpose of quick conversion to revenue.

Usually, fixed assets are the same as tangible assets: physical objects like IT equipment, machinery, or vehicles. Although software is not a physical object, does it count as a fixed asset? In some cases, the answer is yes–it all depends on how exactly an organization utilizes this software. Let’s take an in-depth look at how to categorize computer software among your assets along with tips to effectively manage software based on its classification.

Can An Intangible Object Be a Tangible Asset?

There’s no denying that software is an intangible object–it exists solely within IT devices and you certainly can’t hold it in your hand. Typically when it comes to asset categorization, fixed assets and tangible assets are interchangeable terms. While accountants are tasked with labeling computer software as a fixed or intangible asset, the answer varies depending on that software’s use.

In more cases than you would expect, software is classified as both a fixed asset and a tangible asset according to accounting and asset management guidelines. This occurs most commonly when software is classified as equipment. Usually, a company’s equipment–defined in accounting as long-term assets used to generate revenue and assist with day-to-day operations–is something physically tangible. Software may not be, but there are many use cases in which software falls well within the accounting definition of equipment.

This question can be a confusing one because of the difference between software’s physical properties and its classification. A tangible asset doesn’t necessarily need to be a physical object. In an accounting sense, a tangible asset simply means an asset that can be measured.

A tangible asset always has a fixed monetary value, as opposed to the theoretical value of an intangible asset. You can’t easily put a price tag on intangible assets, like intellectual property and copyrights, because it’s difficult to determine whether these assets will pay off in the future, and if so, for how much. But oftentimes, you can put an exact value on computer software and each individual license that comes with it.

Classifying Computer Software As a Tangible Asset or Fixed Asset

If your company opts to categorize computer software as a tangible asset, you should first and foremost be able to measure its worth. Whether you purchase a turnkey application from a vendor, or have a custom software solution made for your company, there is some kind of upfront cost or fixed monthly payment associated with that software.

Beyond the software’s overall cost, its fixed-asset status also depends on its purpose and longevity. When determining if computer software a fixed asset, you will want to ask the 4 following questions:

1. Does This Software Help to Sell a Product?

If the company is using it as a resource, that’s a fixed asset.

2. Is This Software Itself The Product?

If the software is a product for sale or resale, it counts as a current asset.

3. Is This Software Useful in The Long Term, Over Several Accounting Periods?

If a company plans to utilize the software for an extended period, it’s a fixed asset.

4. Does The company Retain Ownership Over This Software Only For a Short Time Before Liquidating It?

If so, it’s a current asset.

In the accounting world, software counts as a fixed asset when it is used like a fixed asset. If your company’s software was purchased for long-term use (aka for more than one accounting period), that makes it subject to fixed asset tracking. If the software is used to deliver goods and services (but is not one of your company’s offered goods or services, such as a SaaS platform), that makes it a tangible asset. Some examples of these long-term, tangible software assets include shipping and logistics management software and website or cloud hosting applications.

Current vs. Fixed Assets: What's The Difference?

Classifying Different Types of Computer Software

There’s another wrinkle to consider when determining if computer software is a fixed asset or intangible asset. Not all types of computer software are created equal or used in the same way. Some computer software is designed to run on one machine. Other kinds of software are cloud-based and accessed remotely through the internet–so even if this software is part of a company’s day to day operations, it isn’t technically in their physical possession. Still, other types of software may be stored within the company’s database, but accessed via a central hub between multiple divisions of the same company.

In all of these cases, whether computer software is a fixed asset has nothing to do with the software’s physical properties, but rather the way the company uses that software. If the computer software is integral to a company’s daily operations over a period of time exceeding one accounting period, it can be classified as long-term equipment, and therefore remains a fixed and tangible asset. It doesn’t matter whether it’s a custom piece of software that lives in a database in the company’s physical headquarters, or if it’s a cloud-based application that is accessed through unique user licenses.

Just like the other fixed assets your organization relies on, it’s essential to track the status, location, and cost of your software assets. Make sure to log all software assets–including each unique license–into a cohesive asset management platform for easy tracking and assignment. In order to maintain accurate data, consider performing a fixed asset audit at least once a year. Additionally, when software is counted as a fixed asset, it will depreciate over time. Consider the initial purchase price of the software plus its current upkeep cost; this is referred to as fixed asset depreciation.

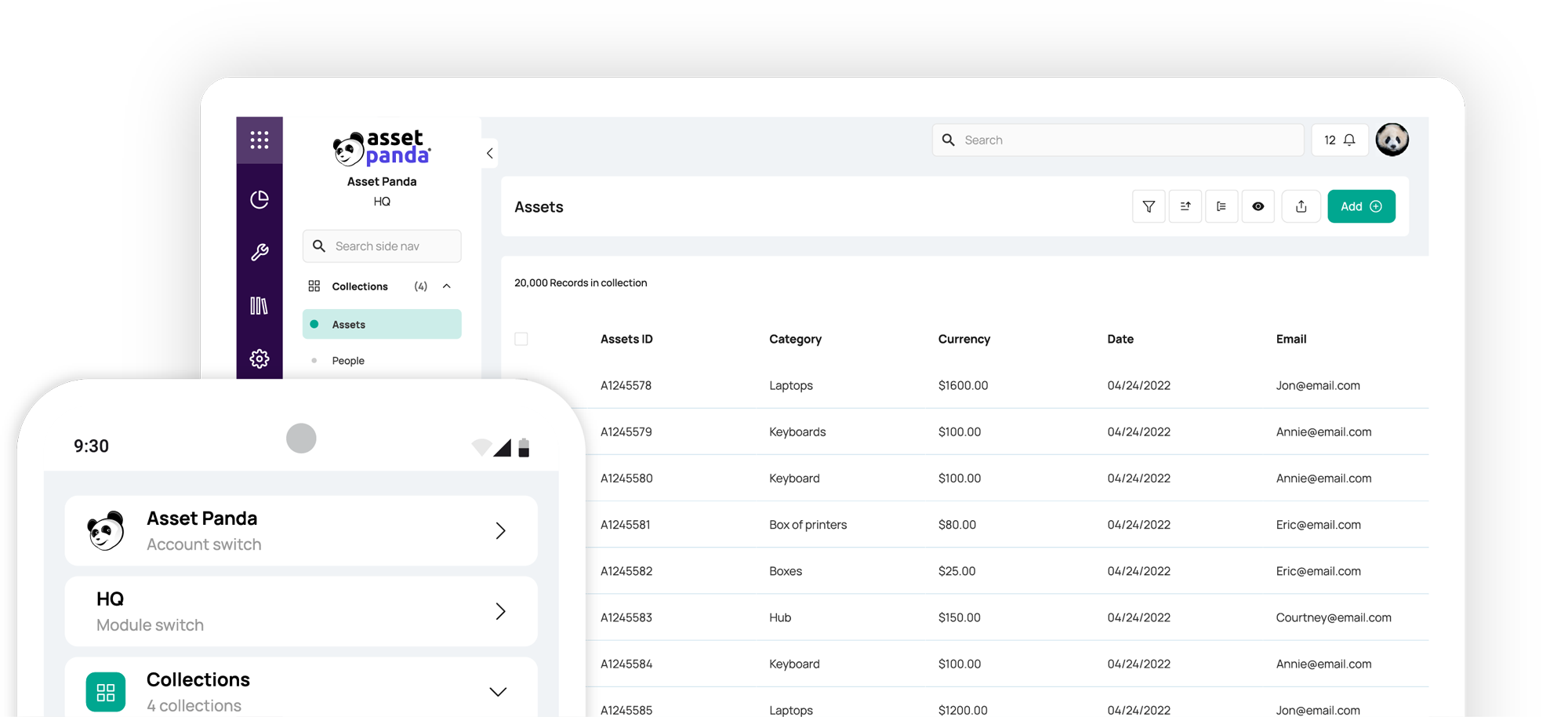

Tracking Software Assets With Asset Panda

Classifying your various software assets is vital to ensuring an accurate balance sheet. Once you’ve successfully categorized your software assets, you can take the guesswork out of managing them with a dedicated asset tracking platform. Asset Panda’s powerful solution allows companies of all sizes to track their fixed assets in real time and manage their full lifecycle history for effortless accounting.

From software assets to furniture, Asset Panda can be customized to manage all your unique assets and workflows in one centralized solution. Add unlimited users to your platform to quickly assign assets to employees and enhance accountability. Plus, manage your assets from anywhere with our companion mobile app and create custom barcode labels for your physical assets using our built-in barcode technology.

If you’re looking for a robust solution to manage all your assets–including fixed software assets–look no further. Discover how Asset Panda can meet your unique needs and request your personalized demo today.

Take Control of Your Assets

A personalized demo is just one click away.

[addtoany]

Related News & Press

Learn more from a solution specialist

Schedule a demo to find out how you can transform your workflows with Asset Panda Pro

Contact our team at (888) 928-6112